新加坡

Essentials of Services Marketing - 1st Edition 豆瓣

作者:

Christopher H. Lovelock

/

Jochen Wirtz

…

Pearson Education

2008

- 8

Crossroads 豆瓣

作者:

Jim Baker

Benchmark Books

2008

- 11

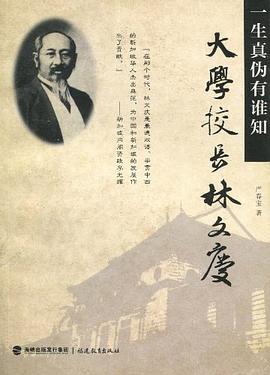

大学校长林文庆 豆瓣

作者:

严春宝

2010

- 4

《大学校长林文庆:一生真伪有谁知》是国内第一部全面介绍私立时期厦门大学校长林文庆博士的传记性著作。作为一位出生于新加坡的海外华人,林文庆博士全程主掌私立厦大16年,为厦门大学赢得了“南方之强”的美誉,但因种种原因,尤其是鲁迅对他寥寥数语的负面评价,致使林文庆博士,成了中国大学发轫史上一个无辜的牺牲品!为了不使历史有负于先人,《大学校长林文庆:一生真伪有谁知》以大量的中外文献史料为依据,力图拨开团团的历史迷雾,吹去层层的政治浮尘,重新向世人诠释林文庆博士那富于传奇性的悲剧人生,使一个爱国者、思想家、教育家、改革家的崇高形象昂然矗立于人们的心中。《大学校长林文庆:一生真伪有谁知》集学术性与资料性于一体,再加上林文庆博士那曲折、传奇般的丰富人生,令读者掩卷之余,也必会感叹:虽然造化有时的确会弄人,但毕竟,历史还是不会欺骗好人的!

Opium and Empire 豆瓣

作者:

Carl A. Trocki

Cornell Univ Pr

1990

Asset Management 豆瓣 Goodreads

作者:

Andrew Ang

Oxford University Press

2014

- 8

Stocks and bonds? Real estate? Hedge funds? Private equity? If you think those are the things to focus on in building an investment portfolio, Andrew Ang has accumulated a body of research that will prove otherwise.

In his new book Asset Management: A Systematic Approach to Factor Investing, Ang upends the conventional wisdom about asset allocation by showing that what matters aren't asset class labels but the bundles of overlapping risks they represent. Making investments is like eating a healthy diet, Ang says: you've got to look through the foods you eat to focus on the nutrients they contain. Failing to do so can lead to a serious case of malnutrition-for investors as well as diners.

The key, in Ang's view, is bad times, and the fact that every investor's bad times are somewhat different. The notion that bad times are paramount is the guiding principle of the book, which offers a new approach to the age-old problem of where do you put your money? Years of experience, both as a finance professor and as a consultant, have led Ang to see that the traditional approach, with its focus on asset classes, is too crude and ultimately too costly to serve investors adequately. He focuses instead on "factor risks," the peculiar sets of hard times that cut across asset classes, and that must be the focus of our attention if we are to weather market turmoil and receive the rewards that come with doing so. Optimally harvesting factor premiums-on our own or by hiring others-requires identifying your particular set of hard times, and exploiting the difference between them and those of the average investor.

Clearly written yet chock-full of the latest research and data, Asset Management will be indispensable reading for trustees, professional money managers, smart private investors, and business students who want to understand the economics behind factor risk premiums, harvest them efficiently in their portfolios, and embark on the search for true alpha.

In his new book Asset Management: A Systematic Approach to Factor Investing, Ang upends the conventional wisdom about asset allocation by showing that what matters aren't asset class labels but the bundles of overlapping risks they represent. Making investments is like eating a healthy diet, Ang says: you've got to look through the foods you eat to focus on the nutrients they contain. Failing to do so can lead to a serious case of malnutrition-for investors as well as diners.

The key, in Ang's view, is bad times, and the fact that every investor's bad times are somewhat different. The notion that bad times are paramount is the guiding principle of the book, which offers a new approach to the age-old problem of where do you put your money? Years of experience, both as a finance professor and as a consultant, have led Ang to see that the traditional approach, with its focus on asset classes, is too crude and ultimately too costly to serve investors adequately. He focuses instead on "factor risks," the peculiar sets of hard times that cut across asset classes, and that must be the focus of our attention if we are to weather market turmoil and receive the rewards that come with doing so. Optimally harvesting factor premiums-on our own or by hiring others-requires identifying your particular set of hard times, and exploiting the difference between them and those of the average investor.

Clearly written yet chock-full of the latest research and data, Asset Management will be indispensable reading for trustees, professional money managers, smart private investors, and business students who want to understand the economics behind factor risk premiums, harvest them efficiently in their portfolios, and embark on the search for true alpha.

Neuroscience 豆瓣

作者:

Dale Purves

/

George J. Augustine

…

Oxford University Press

2017

- 10

This comprehensive textbook provides a balance of animal and human studies to discuss the dynamic field of neuroscience from cellular signaling to cognitive function. The book's length and accessible writing style make it suitable for both medical students and undergraduate neuroscience courses. Each new book includes a one-year subscription to Sylvius 4 Online.