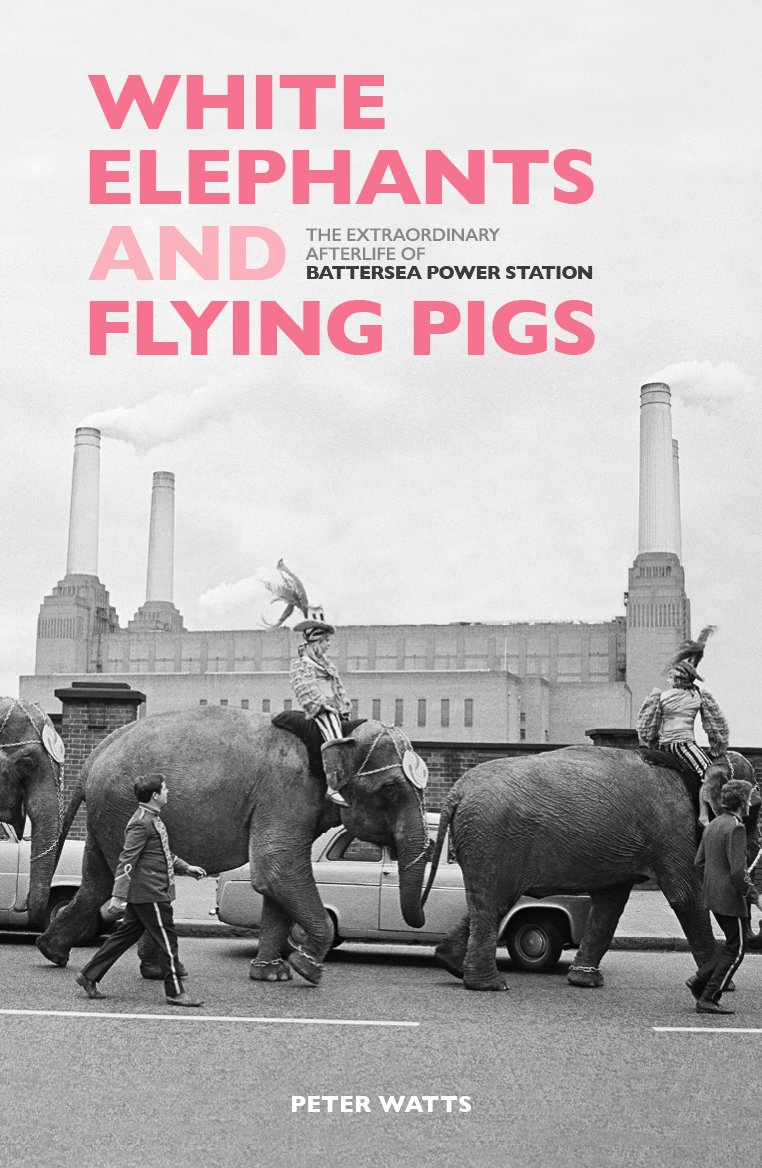

White Elephant and Flying Pigs

作者:

Peter Watts

Paradise Road

2025

In 2022 the public was allowed for the first time inside Battersea Power Station, as it was relaunched as a multi-use shopping mall, entertainment destination and office complex. Prior to this, the much-loved brick cathedral had stood empty for over 30 years, a monumental ruin, beloved of film and album-cover-art directors. Yet behind the scenes there was always plenty going on. The building changed hands multiple times as developers staked their fortunes on it, and invariably lost. It was going to be a theme park. A museum of science and industry. A super-sized cinema complex. A home for the Cirque du Soleil. A new stadium for Chelsea football club. Michael Jackson wanted to buy it.

White Elephants and Flying Pigs explores the power station’s history, from conception and construction, through use and obsolescence, into its long years of stagnation. In this book, former workers, politicians, lords, architects, planners, entrepreneurs, urban explorers and makers of inflatable pigs tell the story of this brooding brick hulk. Ultimately, it’s a story about London and the city we would like it to be.

White Elephants and Flying Pigs explores the power station’s history, from conception and construction, through use and obsolescence, into its long years of stagnation. In this book, former workers, politicians, lords, architects, planners, entrepreneurs, urban explorers and makers of inflatable pigs tell the story of this brooding brick hulk. Ultimately, it’s a story about London and the city we would like it to be.