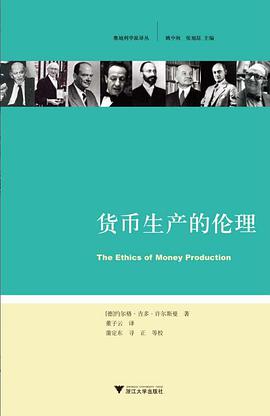

This pioneering work, in hardback, by Jörg Guido Hülsmann, professor of economics at the University of Angers in France and the author of Mises: The Last knight of Liberalism, is the first full study of a critically important issue today: the ethics of money production.

He is speaking not in the colloquial sense of the phrase "making money," but rather the actual production of money as a commodity in the whole economic life. The choice of the money we use in exchange is not something that needs to be established and fixed by government.

In fact, his thesis is that a government monopoly on money production and management has no ethical or economic grounding at all. Legal tender laws, bailout guarantees, tax-backed deposit insurance, and the entire apparatus that sustains national monetary systems, has been wholly unjustified. Money, he argues, should be a privately produced good like any other, such as clothing or food.

In arguing this way, he is disputing centuries of assumptions about money for which an argument is rarely offered. People just assume that government or central banks operating under government control should manage money. Hulsmann explores monetary thought from the ancient world through the middle ages to modern times to show that the monopolists are wrong. There is a strong case in both economic and ethical terms for the idea that money production should be wholly private.

He takes on the "stabilization" advocates to show that government management doesn't lead to stability but to inflation and instability. He goes further to argue against even the theoretical case for stabilization, to say that money's value should be governed by the market, and that that the costs associated with private production are actually an advantage. He chronicles the decline of money once nationalized, from legally sanctioned counterfeiting to the creation of paper money all the way to hyperinflation. In his normative analysis, the author depends heavily on the monetary writings of 14th century Bishop Nicole Oresme, whose monetary writings have been overlooked even by historians of economic thought. He makes a strong case that "paper money has never been introduced through voluntary cooperation. In all known cases it has been introduced through coercion and compulsion, sometimes with the threat of the death penalty. … Paper money by its very nature involves the violation of property rights through monopoly and legal-tender privileges."

The book is also eerily prophetic of our times:

Consider the current U.S. real-estate boom. Many Americans are utterly convinced that American real estate is the one sure bet in economic life. No matter what happens on the stock market or in other strata of the economy, real estate will rise. They believe themselves to have found a bonanza, and the historical figures confirm this. Of course this belief is an illusion, but the characteristic feature of a boom is precisely that people throw any critical considerations overboard. They do not realize that their money producer—the Fed—has possibly already entered the early stages of hyperinflation, and that the only reason why this has been largely invisible was that most of the new money has been exported outside of the U.S… Because a paper-money producer can bail out virtually anybody, the citizens become reckless in their speculations; they count on him to bail them out, especially when many other people do the same thing. To fight such behavior effectively, one must abolish paper money. Regulations merely drive the reckless behavior into new channels.

Hulsmann has provided not only a primer in understanding our times, but a dramatic extension of the work of Menger, Mises, Hayek, Rothbard, and others to map out an economically radical and ethically challenging case for the complete separation of money and state, and a case for the privatization of money production. It is a sweeping and learned treatise that is rigorous, scholarly, and radical.

Table of Contents

Preface

Introduction

Money Production and Justice

Remarks about Relevant Literature

Part 1: The Natural Production of Money

Monies

The Division of Labor without Money

The Origin and Nature of Money

Natural Monies

Credit Money

Paper Money and the Free Market

Electronic Money

Money Certificates

Certificates Physically Integrated with Money

Certificates Physically Disconnected from Money

Money within the Market Process

Money Production and Prices

Scope and Limits of Money Production.

Distribution Effects

The Ethics of Producing Money

The Ethics of Using Money

Utilitarian Considerations on the Production of Money

The Sufficiency of Natural Money Production

Economic Growth and the Money Supply

Hoarding

Fighting Deflation

Sticky Prices

The Economics of Cheap Money

Monetary Stability

The Costs of Commodity Money

Part 2: Inflation

General Considerations on Inflation

The Origin and Nature of Inflation

The Forms of Inflation

Private Inflation: Counterfeiting Money Certificates

Debasement

Fractional-Reserve Certificates

Three Origins of Fractional-Reserve Banking

Indirect Benefits of Counterfeiting in a Free Society .

The Ethics of Counterfeiting

Enters the State: Fiat Inflation through Legal Privileges

Treacherous Clerks

Fiat Money and Fiat Money Certificates

Fiat Inflation and Fiat Deflation

Legalized Falsifications

Legalizing Debasement and Fractional Reserves

The Ethics of Legalizing Falsifications

Legal Monopolies

Economic Monopolies versus Legal Monopolies

Monopoly Bullion

Monopoly Certificates

The Ethics of Monetary Monopoly

Legal-Tender Laws

Fiat Equivalence and Gresham’s Law

Bimetallism

Legal-Tender Privileges for Money Certificates

Legal-Tender Privileges for Credit Money

Business Cycles

Moral Hazard, Cartelization, and Central Banks

Monopoly Legal Tender

The Ethics of Legal Tender

Legalized Suspensions of Payments

The Social Function of Bankruptcy

The Economics of Legalized Suspensions

The Ethics of Legalized Suspensions

Paper Money

The Origins and Nature of Paper Money

Reverse Transubstantiations

The Limits of Paper Money

Moral Hazard and Public Debts

Moral Hazard, Hyperinflation, and Regulation

The Ethics of Paper Money

The Cultural and Spiritual Legacy of Fiat Inflation

Inflation Habits

Hyper-Centralized Government

Fiat Inflation and War

Inflation and Tyranny

Race to the Bottom in Monetary Organization

Business under Fiat Inflation

The Debt Yoke

Some Spiritual Casualties of Fiat Inflation

Suffocating the Flame

Part 3: Monetary Order and Monetary Systems

Monetary Order

The Natural Order of Money Production

Cartels of Credit-Money Producers

Fiat Monetary Systems in the Realm of the Nation-State

Toward National Paper-Money Producers: European Experiences

Toward National Paper-Money Producers: American Experiences

The Problem of the Foreign Exchanges

International Banking Systems, 1871–1971

The Classical Gold Standard

The Gold-Exchange Standard

The System of Bretton Woods

Appendix: IMF and World Bank after Bretton Woods

International Paper-Money Systems, 1971– ?

The Emergence of Paper-Money Standards

Paper-Money Merger: The Case of the Euro

The Dynamics of Multiple Paper-Money Standards

Dead End of the World Paper-Money Union

Conclusion

Two Concepts of Capitalism

Monetary Reform

References

Index of Names

Index of Subjects